While commenting on yesterday's NYT joke of a profile of the New York Fed POMO group, we openly mocked the claim by one Mr. Frost who said that when monetizing debt "We are looking to get the best price we can for the taxpayer.” We politely suggested that this is a blatant, tendentious lie, and that in fact the New York Fed merely cares to gift the Primary Dealers with any price it can for their bonds just so it stays on their good side (think Primary Dealer Auction take down over 50%), and after all - it is only money that according to Steve Liesman appears out of thin air. Earlier today, we suggested a simple experiment that would confirm whether or not this is the case: specifically, if any of the monetized bonds by the Fed ended up being on the part of the curve seen as rich to the spline, it would immediately become obvious that PDs, instead of monetizing the "cheap to sector" bonds, or those on which the PDs are making a capital gains profit, are making up for capital losses through side arrangements with the Fed, specifically in the form of wide bid/ask spreads resulting in taxpayer funded commission gifting. Sure enough, this is exactly what has transpired.

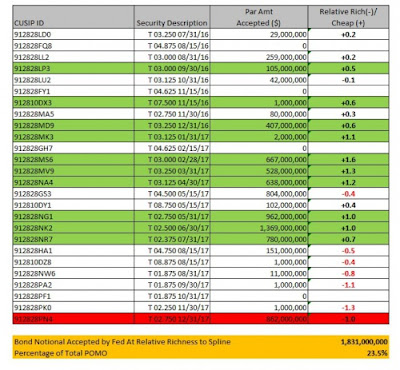

As the chart below shows, while the 10 bonds suggested to be monetized were all in fact tendered, leading to a hit rate of 100%, the notional represented by this sample which was all "cheap to sector" was just 70% of the total. Of the balance, a whopping 78% (or 23.5% of the total) was accounted for by CUSIPs which were rich to the sector, meaning the PDs were at a relative disadvantage when submitting these for Fed buybacks, and likely ended up losing money on the transaction.

What made up for this P&L mismatch and incentivized the PDs to sell to the Fed at a capital loss? Why cumulative commissions of course. Which means that it is now up to those few uncorrupt congressional critters to immediately submit a letter to Messrs Frost, Sack and, of course, Goldman liaison Bill Dudley (not forgeting to cc: the Chairman himself) and demand to find out just what is the fuzzy logic in the algorithm used by the 20 year olds NYU student at the FRBNY POMO desk, and just how much in taxpayer funds does each and every POMO transaction gift to the 18 Primary Dealers, whose bonuses per banker, as far as we understand, will be the second highest in history for 2009. Surely we can commiserate with the Fed's desire to create a wealth effect at such impoverished institutions as Goldman Sachs and fund billions in commissions directly to the govvie traders, but doing so at the expense of more billions in bond issuance which will never be repaid anyway, is something that we believe is time for Congress to have some say on.

Source

3 comments:

Does anyone ---- anyone at all? -- still think your Senators, Representatives, Cabinet members, etc, have OUR best interests in mind? Think they are concerned about "debt" or "taxpayers"? They are SOAKING us for every diem they can and our leaders are smiling, nodding their heads, winking at them and letting them get away with transactions like this because they think we (the people) are just too stupid or too busy trying to keep our jobs to notice....things are gonna change, no doubt.

Nothing will change. Its just a waiting game til the final collapse. We once believed in a place called Rome, how many believe anymore.

If they can write this stuff increasing the acronyms to every other word, it would help. I have trouble with plain english when all the words are spelled out....

Post a Comment