DelMarVa's Premier Source for News, Opinion, Analysis, and Human Interest Contact Publisher Joe Albero at alberobutzo@wmconnect.com or 410-430-5349

Attention

Friday, December 31, 2010

Starting Out 2011 With A Clean Slate

Because we didn't want the Downtown area to look like a slum, Sparkle Wash was able to come in today and clean off the graffiti on my building to assure everyone we will not stand for such childish behavior.

As I stated in comments, its a building and material items can be replaced or fixed. I have spoken with a Realtor and I will put this building up for sale. It's just not worth risking a historic building to some low life jackasses who feel defacing such a structure hurts me personally. They couldn't be more wrong. They're hurting an entire community and no public official or Police Agency is going to stand for it.

So we clean the slate for 2010 and enter 2011 as if nothing ever happened. If you're interested in the building, (before I sign any contracts) you can call me at 410-430-5349 or e-mail me at alberobutzo@wmconnect.com and we can discuss it.

In closing I'd like to thank Sparkle Wash for their fine work and speedy repairs.

HELP WANTED

Help Needed! Cathy’s Pet Salon, Spa & Doggie Daycare is looking for a Doggie Daycare Nanny. Duties include: responsibility for entertaining and disciplining large and small dogs, group playing outside and inside, computer skills a must, meeting and greeting pet owners, bathing dogs, and cleaning. 30 hours per week to start. Send information with references and phone numbers to: CathysPetSalon@yahoo.com or fax to: 410-546-0033.

2011

There were probably many, many times this year when

I may have.....

Disturbed You,

Troubled You,

Pestered You,

Irritated You,

Bugged You,

or got on your Nerves!!

So today, I just wanted to tell you....

Suck it up Cupcake!!

Cause there

AIN'T NO CHANGES

Planned for 2011!!

Cause there

AIN'T NO CHANGES

Planned for 2011!!

I'm Looking For True Animal Lovers

The day after Christmas we had gone out early in the morning to do some shopping. As you'll recall, it snowed quite heavily that day and when we returned home we saw footprints in the snow running down our driveway. We knew our animals were inside and wondered where all these footprints had come from.

The next morning I got up early and saw two black puppy labs on my front porch. When I went outside to coax they towards me they simply took off and ran down the driveway, across the street and into the woods. While out plowing sidewalks and driveways my Wife called me and said, there's some black lab puppies running around the font yard. I explained how I had seen them earlier and asked if she could coax them towards her. She replied no.

Yesterday morning I went outside and heads a noise under my Motor Coach. I had made sure I left our barn door open just in case the puppies returned, they'd have a warmer place to stay. Turns out when they saw me they ran right into the barn. My neighbor was kind enough to supply us way some straw and they slept really well last night after some fresh water, cooked chicken breasts and dog food.

However, they're scared to death and clearly aren't used to being around people. We'll fix that, no problem. However, I'm looking for a Family or two who can adopt these little guys. Someone purposely dropped them off at our property in the snow and they need some lovin.

Since we have all of our animals indoors right now, adding two more just won't cut it. I know I can depend on our readers to come through. My Wife says they're a shepard/lab mix. They look like labs to me but she knows better than I. If you're interested contact me at alberobutzo@wmconnect.com.

The next morning I got up early and saw two black puppy labs on my front porch. When I went outside to coax they towards me they simply took off and ran down the driveway, across the street and into the woods. While out plowing sidewalks and driveways my Wife called me and said, there's some black lab puppies running around the font yard. I explained how I had seen them earlier and asked if she could coax them towards her. She replied no.

Yesterday morning I went outside and heads a noise under my Motor Coach. I had made sure I left our barn door open just in case the puppies returned, they'd have a warmer place to stay. Turns out when they saw me they ran right into the barn. My neighbor was kind enough to supply us way some straw and they slept really well last night after some fresh water, cooked chicken breasts and dog food.

However, they're scared to death and clearly aren't used to being around people. We'll fix that, no problem. However, I'm looking for a Family or two who can adopt these little guys. Someone purposely dropped them off at our property in the snow and they need some lovin.

Since we have all of our animals indoors right now, adding two more just won't cut it. I know I can depend on our readers to come through. My Wife says they're a shepard/lab mix. They look like labs to me but she knows better than I. If you're interested contact me at alberobutzo@wmconnect.com.

Hail To The President

John Robinson had big aspirations when he graduated high school. The yearbook says his plans were "to open up a chain of clock repair stores across the US and in the year 2008 run for President of the United States." (direct quote)!!!!!!!!!

Detectives Probe Assault at Delaware Park

Location: Delaware Park Casino, 777 Delaware Park Blvd., Wilmington, DE

Date of Occurrence: Thursday, December 30, 2010 at 11:40 p.m.

Victim: 48 year old Sewell, NJ man

Defendant:

-Edwin O. Mitchell, Jr., 48, Wilmington, DE

Charge:

-Assault 1st Degree

Resume:

Wilmington- A New Jersey man is in critical condition following an assault that took place at Delaware Park Casino late last night.

The incident occurred at approximately 11:40 p.m. on Thursday evening as a 48 year old man from Sewell, NJ became involved in a verbal altercation with Edwin O. Mitchell, Jr., of Wilmington, DE, over a seat at a blackjack table. The victim and Mitchell agreed to resume the argument outside of the casino and both responded to the valet parking area. The two subjects continued arguing and at one point Mitchell struck the victim in the face with his fist. The victim stumbled backwards and was then struck an additional four times by Mitchell which caused the victim to fall and strike his head on the concrete sidewalk. Mitchell then walked away but was apprehended by casino security in a parking lot. The victim was transported by EMS to the Christiana Hospital where he was admitted in critical but stable condition with severe head injuries.

Edwin O. Mitchell, Jr., was arrested and charged with one count of Assault 1st degree. He was arraigned and then committed to the Howard Young Correctional Facility on $20,000.00 cash bail.

"Hyperinflation Will Drive Gold To Unthinkable Heights"

We now live in a world where governments print worthless pieces of paper to buy other worthless pieces of paper that combined with worthless derivatives, finance assets whose values are totally dependent on all these worthless debt instruments. Thus most of these assets are also worth-less.

So the world financial system is a house of cards where each instrument’s false value is artificially supported by another instrument’s false value. The fuse of the world financial market time bomb has been lit. There is no longer a question of IF it will happen but only WHEN and HOW. The world lives in blissful ignorance of this.

Stockmarkets remain strong and investors worldwide have piled into government bonds in a perceived flight to safety. Due to a century of money creation (and in particular since the 1970s) by governments and by the fractal banking system, investors believe that stocks, bonds and property can only go up. Understanding risk and sound investment principles has not been necessary in these casino markets with guaranteed payouts for anyone who plays the game. Maximum leverage and derivatives have in the last 10-15 years driven markets to unfathomable risk levels, with massive rewards for the participants.

In the meantime central banks are cranking up the printing presses but as Bernanke recently said quantitative easing is an “inappropriate” description of what should be called “securities purchases”! Who is he kidding? What the Fed is buying has nothing to do with “securities”. There is no security whatsoever in the rubbish the Fed is purchasing. They are buying worthless pieces of paper with worthless pieces of paper. This is the Ponzi scheme of all Ponzi schemes.

Let us be very clear, this financial Shangri-La is now coming to an end. The financial system is broke, many western sovereign states are bankrupt and governments will continue to apply the only remedy they know which is issuing debt that will never ever be repaid with normal money.

So why does the world still believe that the financial system is sound?

Hyperinflation Watch

The result of massive money printing is a collapsing currency, leading to escalating prices and eventually hyperinflation. This is in simple terms how every hyperinflationary period in history has happened. If in addition, there are world shortages of food, energy and other commodities, this will accelerate the process.

There are currently a number of indicators all pointing to escalating money printing and an imminent start of a hyperinflationary era. Here are some of them:

Tax receipts are collapsing and government expenditure soaring in many major economies including virtually all southern European countries as well as in the UK. James Turk has produced on his fgmr.com site two excellent graphs for the USA and the UK showing the extreme severity of these two countries’ deficits.

So the world financial system is a house of cards where each instrument’s false value is artificially supported by another instrument’s false value. The fuse of the world financial market time bomb has been lit. There is no longer a question of IF it will happen but only WHEN and HOW. The world lives in blissful ignorance of this.

Stockmarkets remain strong and investors worldwide have piled into government bonds in a perceived flight to safety. Due to a century of money creation (and in particular since the 1970s) by governments and by the fractal banking system, investors believe that stocks, bonds and property can only go up. Understanding risk and sound investment principles has not been necessary in these casino markets with guaranteed payouts for anyone who plays the game. Maximum leverage and derivatives have in the last 10-15 years driven markets to unfathomable risk levels, with massive rewards for the participants.

In the meantime central banks are cranking up the printing presses but as Bernanke recently said quantitative easing is an “inappropriate” description of what should be called “securities purchases”! Who is he kidding? What the Fed is buying has nothing to do with “securities”. There is no security whatsoever in the rubbish the Fed is purchasing. They are buying worthless pieces of paper with worthless pieces of paper. This is the Ponzi scheme of all Ponzi schemes.

Let us be very clear, this financial Shangri-La is now coming to an end. The financial system is broke, many western sovereign states are bankrupt and governments will continue to apply the only remedy they know which is issuing debt that will never ever be repaid with normal money.

So why does the world still believe that the financial system is sound?

- Firstly, because this is what totally clueless governments are telling everyone and this is what investors want to hear.

- Secondly, whether governments apply austerity like in parts of Europe or money printing as in the US, investors want to believe that any action by government is good, however inept.

- Thirdly, market participants are in a state of false security due to shortsightedness and limited understanding of history.

- Fourthly, as long as they can benefit from inflated and false asset values, the market participants will continue to manipulate markets.

- Fifthly, there has been a very skilful campaign by the US to divert the attention from their bankrupt economy and banks `to small European countries like Greece, Ireland or Portugal. These nations, albeit in real trouble, have problems which are miniscule compared to the combined difficulties of the US Federal Government, states, cities and municipalities.

Hyperinflation Watch

The result of massive money printing is a collapsing currency, leading to escalating prices and eventually hyperinflation. This is in simple terms how every hyperinflationary period in history has happened. If in addition, there are world shortages of food, energy and other commodities, this will accelerate the process.

There are currently a number of indicators all pointing to escalating money printing and an imminent start of a hyperinflationary era. Here are some of them:

- Fiscal Gap widening at alarming rates in many major economies.

- Commodity prices at all-time highs.

- Long term interest rates rising.

- Most Currencies falling.

- Precious Metals at all-time highs against most currencies.

Tax receipts are collapsing and government expenditure soaring in many major economies including virtually all southern European countries as well as in the UK. James Turk has produced on his fgmr.com site two excellent graphs for the USA and the UK showing the extreme severity of these two countries’ deficits.

US & UK ON THEIR WAY TO BANKRUPTCY

The USA and the UK are the favourites to reach hyperinflation first amongst major economies. Both these countries will experience major problems in 2011. Also many other nations have unsustainable debt levels which will never be repaid with normal money.

GOVERNMENT DEBT WILL NEVER BE REPAID

Commodity Prices

Commodity prices have increased 26% in the last 12 months and 77% in the last 24 months based on the Continuous Commodity Index (CCI). So whilst most economies publish inflation rates of 1-3%, the real cost of food and energy is surging. The US government, which doesn’t eat or use energy, recently published the adjusted 12 months’ Consumer Price Index (ex food and energy) of 0.8% per annum. Whilst most people are struggling with a massive increase in their cost of living, the US government is continuously adjusting and manipulating the published figures. There are lies damn lies and US government statistics. Who are they fooling!

Long Term Interest Rates

In spite of US government debt being totally worthless, investors have bought more than ever, with virtually no return, in a world drowning in sovereign debt paper. We have for some time stated that the US bond market is one of the biggest financial bubbles ever. As we forecast back then, the market turned down (rates up) in January 2009. A 14 month correction ended in August 2010. Since then both the 10 year and 30 year US Treasury bonds have moved up one full per cent. So investors are finally waking up to the enormous risks in the financial system by selling government debt. We expect both short and long interest to surge in 2011 in many countries and to reach well into double digits in the next few years.

Long Term Interest Rates

In spite of US government debt being totally worthless, investors have bought more than ever, with virtually no return, in a world drowning in sovereign debt paper. We have for some time stated that the US bond market is one of the biggest financial bubbles ever. As we forecast back then, the market turned down (rates up) in January 2009. A 14 month correction ended in August 2010. Since then both the 10 year and 30 year US Treasury bonds have moved up one full per cent. So investors are finally waking up to the enormous risks in the financial system by selling government debt. We expect both short and long interest to surge in 2011 in many countries and to reach well into double digits in the next few years.

INTEREST RATES WILL RISE STRONGLY

In spite of interest rates at minimal levels, both sovereign states and individuals have major problems servicing current debt. With interest rates likely to rise to at least 12-15% and probably higher, no one will be able to service debt with “normal money”. Add to that the fact that government debt will surge in most countries. The US debt is currently $ 14 trillion. It is likely to rise to at least $20 trillion in the next few years and probably a lot higher. The interest cost for the US government at that stage is likely to be at least double the tax revenue. One would assume that the US government is well aware of what their ruinous actions are leading to. But in spite of this, they continue to increase the deficit by reducing fiscal revenues and increasing spending. What planet are they living on! What is absolutely self-evident is that they will not clear up their own mess, as the present government will be a one term wonder!

Currencies Declining

Since 1971, the value of the US dollar (paper money) has gone down 97.5% against real money (gold). Since Nixon abolished gold backing of the US dollar in 1971, both the dollar and most other currencies have been totally destroyed by reckless government. Nixon should not have been impeached for Watergate. Instead he should have been prosecuted and jailed for destroying the world’s currency system. Concurrently, banking developed into a fractal system whereby banks could lend massive multiples of their deposits and capital. All of this has served to drive up asset prices to totally unsustainable levels.

All currencies are declining against gold but some faster than others. The US dollar for example is down 78% against the Swiss Francs since 1972. During the same period the pound has declined a massive 85% against the Swiss Franc. Both the dollar and the pound are now at all-time lows against the Swiss currency. But the Swissy is only strong relative to weak paper currencies because against real money/gold the Swiss Franc has declined 87% since 1972.

Currencies Declining

Since 1971, the value of the US dollar (paper money) has gone down 97.5% against real money (gold). Since Nixon abolished gold backing of the US dollar in 1971, both the dollar and most other currencies have been totally destroyed by reckless government. Nixon should not have been impeached for Watergate. Instead he should have been prosecuted and jailed for destroying the world’s currency system. Concurrently, banking developed into a fractal system whereby banks could lend massive multiples of their deposits and capital. All of this has served to drive up asset prices to totally unsustainable levels.

All currencies are declining against gold but some faster than others. The US dollar for example is down 78% against the Swiss Francs since 1972. During the same period the pound has declined a massive 85% against the Swiss Franc. Both the dollar and the pound are now at all-time lows against the Swiss currency. But the Swissy is only strong relative to weak paper currencies because against real money/gold the Swiss Franc has declined 87% since 1972.

DOLLAR DECLINE WILL ACCELERATE IN 2011

As a consequence of accelerated money printing, all paper currencies will fall precipitously against gold in the next few years. Therefore all paper money should be avoided and especially the Dollar, the Pound and the Euro.

Precious Metals to reach unthinkable heights

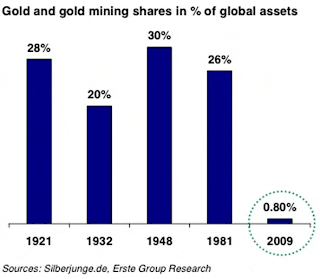

Gold has gone up 40 times against the Dollar in the last 40 years and almost 6 times in the last 11 years. Very few investors have participated in this rise since the 1999 low at $ 250. Less than 1% of world financial assets are invested in gold and gold stocks. Between 1920 and 1980 circa 25% of financial assets were invested in gold and gold stocks.

Precious Metals to reach unthinkable heights

Gold has gone up 40 times against the Dollar in the last 40 years and almost 6 times in the last 11 years. Very few investors have participated in this rise since the 1999 low at $ 250. Less than 1% of world financial assets are invested in gold and gold stocks. Between 1920 and 1980 circa 25% of financial assets were invested in gold and gold stocks.

THERE WILL NOT BE ENOUGH GOLD

The major rise in gold in the last 11 years has been a stealth move with very few investors participating. The dilemma is that there is not enough gold to satisfy the coming increase in demand. We have in previous articles forecasted the gold price to reach anywhere between $ 6,000 and $ 10,000 in the next few years – see “Gold entering a virtuous circle”. As we explained at the time, these are totally realistic targets without the effect of hyperinflation.

GOLD WILL SURGE IN 2011

Bearing in mind that we are likely to see hyperinflation in the US, the UK and many European countries, the $6-10,000 target for gold is much too low. The dilemma is that it is absolutely impossible to predict how much money will be printed by governments. In the Weimar republic gold reached DM 100 trillion. But it is really irrelevant what level gold and other precious metals will reach in hyperinflationary money.

What is much more important to understand is that physical gold (and silver) will protect investors against losing virtually 100% of the purchasing power of their money. Whatever real capital appreciation gold will have in the next few years is of less importance. But what is vital, is that physical gold (stored outside the banking system) is the ultimate form of wealth protection both against a deflationary collapse and a hyperinflationary destruction of paper money.

Throughout history gold has protected investors against various calamities but this time, holding physical gold will be absolutely critical to financial survival.

Source GoldSwitzerland.com

What is much more important to understand is that physical gold (and silver) will protect investors against losing virtually 100% of the purchasing power of their money. Whatever real capital appreciation gold will have in the next few years is of less importance. But what is vital, is that physical gold (stored outside the banking system) is the ultimate form of wealth protection both against a deflationary collapse and a hyperinflationary destruction of paper money.

Throughout history gold has protected investors against various calamities but this time, holding physical gold will be absolutely critical to financial survival.

Source GoldSwitzerland.com

New Year's Eve: Will You Party Or Pray?

A new Rasmussen Report poll shows that while most Americans are not planning to attend a party or go out to dinner on New Year’s Eve, a strong majority, 66 percent, say they will say a prayer before midnight that day.

The percentage of those who plan to pray (66 percent) on New Year’s Eve is larger than the respective percentage of those who are going to drink (42 percent), attend a party (21 percent), and go out for dinner with friends or family (18 percent) to celebrate the new year, the survey found.

“This New Year’s Eve, most Americans don’t plan on attending a party or even a dinner, but a sizable number intend to enjoy a drink. Even more will offer up a prayer as 2010 becomes 2011,” stated the poll , which was released today.

In contrast, 25 percent of Americans say they will not pray before the clock strikes midnight on New Year’s Eve, according to the poll.

While men are more likely than women to party on New Year’s Eve, women are more likely than men to say a prayer that day, the poll revealed.

Furthermore, “Black Americans are also more likely than whites to say a prayer before 2011 begins,” the survey found.

CNS News

The percentage of those who plan to pray (66 percent) on New Year’s Eve is larger than the respective percentage of those who are going to drink (42 percent), attend a party (21 percent), and go out for dinner with friends or family (18 percent) to celebrate the new year, the survey found.

“This New Year’s Eve, most Americans don’t plan on attending a party or even a dinner, but a sizable number intend to enjoy a drink. Even more will offer up a prayer as 2010 becomes 2011,” stated the poll , which was released today.

In contrast, 25 percent of Americans say they will not pray before the clock strikes midnight on New Year’s Eve, according to the poll.

While men are more likely than women to party on New Year’s Eve, women are more likely than men to say a prayer that day, the poll revealed.

Furthermore, “Black Americans are also more likely than whites to say a prayer before 2011 begins,” the survey found.

CNS News

Hunter's --- Interesting

The world's largest army? America's hunters..

Strength of the 2nd Amendment..

I don't spend my fall weekends tramping around the woods in pursuit of a buck, any more, but a lot of my friends and neighbors do. This blogger adds up all the hunters in just a handful of states, and comes to a striking conclusion:

The state of Wisconsin has gone an entire deer hunting season without someone getting killed. That's great. There were over 600,000 hunters. Allow me to restate that number. Over the last two months, the eighth largest army in the world - more men under arms than Iran; more than France and Germany combined - deployed to the woods of a single American state to help keep the deer menace at bay. But that pales in comparison to the 750,000 who are in the woods of Pennsylvania this week. Michigan's 700,000 hunters have now returned home. Toss in a quarter million hunters in West Virginia, and it is literally the case that the hunters of those four states alone would

comprise the largest army in the world. His point? America will forever be safe from foreign invasion with that

kind of home-grown firepower.

Hunting -- it's not just a way to fill the freezer. It's a matter of national security.

Strength of the 2nd Amendment..

I don't spend my fall weekends tramping around the woods in pursuit of a buck, any more, but a lot of my friends and neighbors do. This blogger adds up all the hunters in just a handful of states, and comes to a striking conclusion:

The state of Wisconsin has gone an entire deer hunting season without someone getting killed. That's great. There were over 600,000 hunters. Allow me to restate that number. Over the last two months, the eighth largest army in the world - more men under arms than Iran; more than France and Germany combined - deployed to the woods of a single American state to help keep the deer menace at bay. But that pales in comparison to the 750,000 who are in the woods of Pennsylvania this week. Michigan's 700,000 hunters have now returned home. Toss in a quarter million hunters in West Virginia, and it is literally the case that the hunters of those four states alone would

comprise the largest army in the world. His point? America will forever be safe from foreign invasion with that

kind of home-grown firepower.

Hunting -- it's not just a way to fill the freezer. It's a matter of national security.

Wicomico County Sheriff's Office Press Releases

Incident: Attempted Burglary

Date of Incident: 30 December 2010

Location: Naylor Mill Road at Jersey Road, Salisbury, MD

Suspect:

1. Male Juvenile, 14, Salisbury, MD

2. Male Juvenile, 13, Snow Hill, MD

Narrative: On 30 December 2010 at 1:10 AM, the Wicomico County Sheriff’s Office responded to a call for a reported burglary in progress at a closed convenience store adjacent to the intersection of Naylor Mill and Jersey Roads. The proprietor was still inside the establishment when she heard an unknown subject attempting to kick in the rear door to the building. Upon the arrival of law enforcement, the first deputy observed two juveniles in the front parking lot of the business. Both juvenile denied any involvement with any illegal activities and stated they were merely walking across the property. However, the investigating deputy compared the shoes worn by the two juveniles and concluded they were a match with fresh footprints left in the snow behind the store. Also, one of the tread patterns on one of the juvenile’s shoes also coincided with marks left on the door where they had allegedly tried to kick it open.

Both juveniles were placed under arrest and transported to the Sheriff’s Office where they were processed. The Department of Juvenile Services was contacted in reference to these arrests and the deputy was advised to release both to parents.

Juvenile Referrals were completed and the juveniles were released pending future adjudication.

Charges: Attempted Burglary 2nd Degree

Incident: DUI Enforcement

Date of Incident: 31 December 2010

Location: Wicomico County

Narrative: On New Year’s Eve, the Wicomico County Sheriff’s Office, in conjunction with the Maryland State Police Salisbury Barrack, the Salisbury Police Department and the Fruitland Police Department will be augmenting their normal patrol staffs with officers dedicated to locating drivers behind the wheel who have had too much to drink.

On behalf of Wicomico County’s Law Enforcement agencies, Sheriff Lewis would like to remind everyone to enjoy their holiday weekend and remember to think before they drink. Arrangements for a designated driver or a sober ride home are a must.

Remember that when you are going out Friday evening, so are we!

Date of Incident: 30 December 2010

Location: Naylor Mill Road at Jersey Road, Salisbury, MD

Suspect:

1. Male Juvenile, 14, Salisbury, MD

2. Male Juvenile, 13, Snow Hill, MD

Narrative: On 30 December 2010 at 1:10 AM, the Wicomico County Sheriff’s Office responded to a call for a reported burglary in progress at a closed convenience store adjacent to the intersection of Naylor Mill and Jersey Roads. The proprietor was still inside the establishment when she heard an unknown subject attempting to kick in the rear door to the building. Upon the arrival of law enforcement, the first deputy observed two juveniles in the front parking lot of the business. Both juvenile denied any involvement with any illegal activities and stated they were merely walking across the property. However, the investigating deputy compared the shoes worn by the two juveniles and concluded they were a match with fresh footprints left in the snow behind the store. Also, one of the tread patterns on one of the juvenile’s shoes also coincided with marks left on the door where they had allegedly tried to kick it open.

Both juveniles were placed under arrest and transported to the Sheriff’s Office where they were processed. The Department of Juvenile Services was contacted in reference to these arrests and the deputy was advised to release both to parents.

Juvenile Referrals were completed and the juveniles were released pending future adjudication.

Charges: Attempted Burglary 2nd Degree

Incident: DUI Enforcement

Date of Incident: 31 December 2010

Location: Wicomico County

Narrative: On New Year’s Eve, the Wicomico County Sheriff’s Office, in conjunction with the Maryland State Police Salisbury Barrack, the Salisbury Police Department and the Fruitland Police Department will be augmenting their normal patrol staffs with officers dedicated to locating drivers behind the wheel who have had too much to drink.

On behalf of Wicomico County’s Law Enforcement agencies, Sheriff Lewis would like to remind everyone to enjoy their holiday weekend and remember to think before they drink. Arrangements for a designated driver or a sober ride home are a must.

Remember that when you are going out Friday evening, so are we!

End Of Year Safe Streets #'s

End of year Safe Streets #’s for Salisbury:

- Part One Crimes are down 17.8%

- All Part One crimes are down except Murder – that means fewer Rapes, Robberies, Assaults, Burglaries, Thefts, MV thefts, and Arsons…

- 646 fewer Part One crimes than in 2009

- Robbery down 33%

- Assault down 20%

- Burglary down 21%

Link to newsletter: Newsletter

Baby Boomers Start To Turn 65: 16 Statistics About The Coming Retirement Crisis That Will Drop Your Jaw

Do you hear that rumble in the distance? That is the Baby Boomers – they are getting ready to retire. On January 1st, 2011 the very first Baby Boomers turn 65. Millions upon millions of them are rushing towards retirement age and they have been promised that the rest of us are going to take care of them. Only there is a huge problem. We don’t have the money. It simply isn’t there. But the millions of Baby Boomers getting ready to retire are counting on that money to be there. This all comes at a really bad time for a federal government that is already flat broke and for a national economy that is already teetering on the brink of disaster.

So just who are the Baby Boomers? Well, they are the most famous generation in American history. The U.S. Census Bureau defines the Baby Boomers as those born between January 1st, 1946 and December 31st, 1964. You see, after U.S. troops returned from World War II, they quickly settled down and everyone started having lots and lots of babies. This gigantic generations has transformed America as they have passed through every stage of life. Now they are getting ready to retire.

If you add 65 years to January 1st, 1946 you get January 1st, 2011.

The moment when the first Baby Boomers reach retirement age has arrived.

The day of reckoning that so many have talked about for so many years is here.

Today, America’s elderly are living longer and the cost of health care is rising dramatically. Those two factors are going to make it incredibly expensive to take care of all of these retiring Baby Boomers.

Meanwhile, the sad truth is that the vast majority of Baby Boomers have not adequately saved for retirement. For many of them, their home equity was destroyed by the recent financial crisis. For others, their 401ks were devastated when the stock market tanked.

GO HERE to read more.

So just who are the Baby Boomers? Well, they are the most famous generation in American history. The U.S. Census Bureau defines the Baby Boomers as those born between January 1st, 1946 and December 31st, 1964. You see, after U.S. troops returned from World War II, they quickly settled down and everyone started having lots and lots of babies. This gigantic generations has transformed America as they have passed through every stage of life. Now they are getting ready to retire.

If you add 65 years to January 1st, 1946 you get January 1st, 2011.

The moment when the first Baby Boomers reach retirement age has arrived.

The day of reckoning that so many have talked about for so many years is here.

Today, America’s elderly are living longer and the cost of health care is rising dramatically. Those two factors are going to make it incredibly expensive to take care of all of these retiring Baby Boomers.

Meanwhile, the sad truth is that the vast majority of Baby Boomers have not adequately saved for retirement. For many of them, their home equity was destroyed by the recent financial crisis. For others, their 401ks were devastated when the stock market tanked.

GO HERE to read more.

Special Education Teacher Charged With Heroin Possession

SILVER SPRING, Md. - A Montgomery County special education teacher faces charges of heroin possession after police discovered she had drugs in her possession during a traffic stop Tuesday night.

Rebecca Amick, 25, of North Potomac was a passenger in a car stopped by Montgomery County Police. Police stopped the car for a speeding violation. The driver was going 40 mph in a 30-mph zone near the intersection of Georgia Avenue and Thayer Avenue in Silver Spring.

Police say the driver and two passengers, who appeared nervous, agreed to a search of the vehicle and to personal searches during the 7:45 p.m. traffic stop.

Police say Amick, a teacher at Woodlin Elementary School in Silver Spring, had in her possession nine bags of heroin. Each of the bags contained one-tenth of a gram of heroin. The drugs had a street value of $90.

Amick, who was in the back seat of the vehicle, was charged with possession and released on personal recognizance.

Police say the search turned up two syringes and a spoon.

GO HERE to read more.

Rebecca Amick, 25, of North Potomac was a passenger in a car stopped by Montgomery County Police. Police stopped the car for a speeding violation. The driver was going 40 mph in a 30-mph zone near the intersection of Georgia Avenue and Thayer Avenue in Silver Spring.

Police say the driver and two passengers, who appeared nervous, agreed to a search of the vehicle and to personal searches during the 7:45 p.m. traffic stop.

Police say Amick, a teacher at Woodlin Elementary School in Silver Spring, had in her possession nine bags of heroin. Each of the bags contained one-tenth of a gram of heroin. The drugs had a street value of $90.

Amick, who was in the back seat of the vehicle, was charged with possession and released on personal recognizance.

Police say the search turned up two syringes and a spoon.

GO HERE to read more.

How Do I Record An Illegal Debt Collector?

Shannon keeps getting calls from a debt collector that violate the law so she wants to catch them in the act. The collector calls herself "Investigator" and claims that Shannon is part of a "serious investigation" and has threatened her with jail time if she doesn't pay up. The "Investigator" keeps calling her at work and has also called up her coworkers and told them that Shannon is part of an investigation. Shannon needs help figuring out how to record these calls.

More »

More »

FTC Wants To Ban Mortgage Mod Services From Charging Up-Front Fees

To combat mortgage relief fraud, the FTC would like to make a new rule that would ban mortgage modification services from charging up-front fees. "Homeowners facing foreclosure or struggling to make mortgage payments shouldn't have to contend with fraudulent 'companies' that don't provide what they promise," FTC Chairman Jon Leibowitz said in a statement. "The proposed rule would outlaw up-front fees so companies can't take the money and run." Indeed, there are some shady operators in this area and consumers need to beware.

More »

More »

Jobless Claims Drop To July 2008 Levels

In a potential sign of a mending economy, unemployment claims for the week ending Dec. 25 fell 34,000 to 388,000, the lowest levels since July 2008. However, the good news might be slightly enhanced by it being the week of Christmas, which can throw a wrench into into how the claims are tallied. The last two years have seen the same trend, with claims then jumping upward in January. The news was received by unemployed folks in the same way as when you were a kid you found a cool wrapped present only to discover it was only a decoration.

More »

More »

Can Haley Barbour Survive His Gaffes?

Multisource political news, world news, and entertainment news analysis by Newsy.com

Mississippi Gov. Haley Barbour's comments to a conservative magazine have analysts questioning his viability as a 2012 presidential candidate.Oprah's OWN Set To Debut January 1st

Multisource political news, world news, and entertainment news analysis by Newsy.com

The Oprah Winfrey Network is set to debut January 1st. We're analyzing the rumors, hype, and challenges it will face ringing in the new year.Somerset County Sheriff's Office Press Releases

Mark Dulaney Wheatley of Princess Anne, Criminal summons served 12-15-10 for theft over $1,000 and trespassing. Deputies investigated a theft of old farm tractor radiators from a farm on Old princess Anne Rd, and later determined that Wheatley removed the radiators and sold them for scrap. Wheatley was released pending trial.

Antonio Ray Maness of Princess Anne, arrested 12-23-10 on two warrants regarding failing to appear in court for child support. Maness was later held on a $1,000 bond.

Loretta Lee Phillips of Salisbury, arrested 12-23-10 on a warrant regarding failing to appear in court for child support. Phillips was later held on a $500.00 bond.

Morgan Felix White Jr. of Princess Anne, arrested 12-19-10 of a warrant regarding violation of probation. White was later held on a $35,000 bond.

George William Donophan Jr. of Princess Anne, arrested 12-29-10 on a warrant regarding failing to appear in District Court. Donophan was later held on a $2,500 bond.

Deandre Maurice Taylor of Princess Anne, arrested 12-30-10 on a warrant regarding two warrants regarding failing to appear in court for child support. Taylor was later held on a $1,000 bond.

COOKIES

Just click on the name of the cookie and bam the recipe is there. Good to keep handy.

1-2-3 Cookies 7 Layer Cookies Allie Nelson's Famous Snickerdoodle Cookies Almond Crescent Shortbread Amish Sugar Cookies Andies Candies Cookies Angel Crisps Angenets Applesauce Cookies Apricot Fold-Overs Aunt Edy's Molasses Crinkles Auntie Linda's Ginger Gems Bakeless Dream Cookies Banana Drop Cookies Best Chocolate Chip Cookies in the World Biscotti Biscotti Blueberry Cookies Boiled Chocolate Oatmeal Drop Cookies Bronwnies Brown Sugar Shortbread Brownie Cookies Brownie Delight Brownies Buccaneer Snowballs Buried Cherry Cookies Butter Cookies Butter Nut Balls Butterballs Butterscotch Haystacks C.O.P. Cookies Candy Cane Cookies Candy Cookies Caramel Shortbread Cheesecake Brownies Cherry Buns Cherry Crowns Cherry Winks Chewies Chewy Noels Chinese Chews/Haystacks Chocolate Chip Cookie Bars Chocolate Chip Cookies Chocolate Chip Meltaways Chocolate Chip Peanut Butter Cookies Chocolate Christmas Trees Chocolate Cream Cheese Squares Chocolate Crinkles Chocolate Mint Snow-Top Cookies Chocolate Oatmeal Cookies (no bake) Chocolate Snowball Cookies Chocolate Streusel Bars Chocolate Sundae Cookies Chocolate Walnut Crumb Bars Choco-Scotch Crunchies Choose A Cookie Dough Recipe Christmas Crackers Christmas Crunch Bars Christmas Ginger Snaps Christmas Macaroons Christmas Mice Cookies Christmas Shaped Cookies Church Window Cookies Coconut Cookies Congo Squares Cookie in a Jar Corn Flakes Cookies Cornflake Christmas Wreaths Cowboy Cookies (oatmeal) Cream Cheese Cookies with Apricot Filling Crème De Menthe Chocolate Squares Crème Wafers Crescent Cookies Crispy Crunchies Date Nut Balls Date-nut Pinwheel Cookies Diabetic Peanut Butter Cookies Disgustingly Rich Brownies Doodles Double chocolate chip cookies Double-Chocolate Crinkles Eatmore Cookies Eggnog Cookies Elizabeth's Sugar Cookies Elves Quick Fudge Brownies Emily Dickinson's Gingerbread Cookie Recipe Emily's Best Brownies Famous Oatmeal Cookies Firemen Cookies Fluffy Shortbread Cookies Forgotten Cookies Frosted Peanut Butter Brownies Fruit Cake Cookies Fruitcake Squares Fry Pan Cookies Gems Ginger Cookies Ginger Crinkles Gingerbread Baby Gingerbread Cookies with Butter Cream Icing Gingerbread Men Gingerbread Men Ginny's Gluten Free Chocolate Chip Cookies Glory's Golden Graham Squares Glory's Sugar Cookies Gramma Chapman's chocolate coconut drops Grandma Elsie's Zimt (cinnamon) Cookies Grandma J's Butter Cookies Grandma Olson's Parkay Cookies Great Grandmothers Sugar Cookies Gum Drop Cookies Gumdrop Gems Haystack Cookies Ho-Ho Bars Holiday Cereal Snaps Holiday Chocolate Butter Cookies Holiday Raisin Walnut Bars Holly Cookies Hungarian Cookies (Little Nut Rolls) Ice Box Cookies Irresistible Peanut Butter Cookies Italian Cookies Jacob's Peppermint Snowballs Jam Bars Jessica's Famous Brownies Jessie's Chocolate Chip Cookies Jubilee Jumbles Juliet's Peanut Butter Blossoms Jumbo Chocolate Chip Cookies Kentucky Colonels Kiefle (cream cheese cookies with jam filling) Kifflings Kiss Cookies Lacy Swedish Almond Wafers Lemon Angel Bar Cookies Lemon Bars Lemon Cake Cookies Lemon Cream Cheese Cookies Lemon Squares Linzer Tarts Log Cabin Cookies Luscious Lemon Squares M&M Cookies Magic Cookie Bars Melt in Your Mouth Cutout Sugar Cookies Melting Shortbread Meme's Cream Cheese Cookies Milk Chocolate Florentine Cookies Mincemeat Cookies Mincemeat Goodies Molasses Cookies Molasses Forest Cookies Molasses Sugar Cookies Mom Mom's Crescent Cookies Mom-Mom's Ginger Cookies Mom's Nutmeg Sugar Cookies Mom's Old Fashion 'Puffy' Sugar Cookies Monster Cookies Moravian Christmas Cookies Nana's Famous Soft Southern Cookies Nitey Nite Cookies No Bake Chocolate Cookies No Bake Chocolate Oatmeal Cookies No Bake Cookies No Bake Cookies No Bake Peanut Butter Cookies No-Bake Chocolate Oatmeal Cookies No-Bake Cookies Norwegian Sugar Cookies Nut Balls Oatmeal Bars Oatmeal Chocolate Chip Nut Cookies Oatmeal Coconut Crisps Oatmeal Cookies Oatmeal Scotchies Old Fashioned Sugar Cookies Ooey Gooey Caramel Chocolate Dunk Ooey Gooey Squares Orange Slice Cookies Parking Lot Cookies Peanut Blossoms Peanut Butter Bars Peanut Butter Blossoms Peanut Butter Cereal Cookies Peanut Butter Chewies Peanut Butter Chocolate Bars Peanut Butter Cookies Peanut Butter Cookies Peanut butter fingers Peanut Butter Reindeer Peanut Butter Surprises Peanut Marshmallow Cookies Pecan Puff Cookies Peppermint Snowballs Peppernuts Persimmon Cookies Persimmon Cookies Petey's Yummy Spicy Almond Thins Pfeffernuesse Pffefferneuse Cookies Pineapple Filled Cookies Pizzelles Potato Chip Cookies Potato Flake Cookies Praline Cookies Praline Strips Pterodactyl Nests Pumpkin Bars Pumpkin Bars Pumpkin Chip Cookies Pumpkin Chocolate Chip Cookies Pumpkin Cookies Queen Biscuits Quick Cookies Raised Sugar Cookies Raisin Filled Oatmeal Bars Raspberry Meringue Bars Really Peanutty Butter Cookies Reese`s Brownies Reese's Peanut Butter Bars Rich Flavor Christmas Cookies Rich Lemon Bars Ricotta Cheese Cookies Royal Almond Christmas Bars Rudolph Cinnamon Cookies Russian Tea Cookies Russian Teacakes Samantha & Kelsey's Chocolate Chip Cookies Sand Art Brownies Santa Claus Cookie Pops Santa Claus Cookies Santa's Butterscotch Melts Santa's Shorts Santa's Special Squares Scotch Cakes Scotch Shortbread Scotcharoos Scotcheroos Seven Layer Cookies Short Bread Cookies Shortbread Skor Squares Snicker Doodle Cookies Snickerdoodles Snickerdoodles Snow Balls Sour Cream Apple Squares Sour Cream Christmas Cookies Special K Cookies Spice Cookies Spicy Oatmeal Raisin Cookie Spritz Cookies Stained Glass Window Cookies Stir & Drop Sugar Cookies Sugar Cookies Sugar Cookies Sugar Cookies Swedish Pepparkakor (Pepper Cake) Cookies Swedish Sugar Cookies Sweet Marie's Swiss Treats Taralle (Italian Cookies) Tea Time Tassies Texas Brownies The Best Shortbread in The World Thumbprint Cookies Thumbprint Cookies Toffee Squares Traditional Christmas Sugar Cookies Traditional Gingerbread Men Cookies Triple-Chocolate Chip Cookies Ultimate Chocolate Chip Cookies Vanilla Waffer Balls Walnut Butter Cookies Walnut Crumb Bars White Chip Chocolate Cookies Wild Oatmeal Cookies Will's Famous Apple Jack Cookies Yummy Yummy Peanut Butter Blossoms

1-2-3 Cookies 7 Layer Cookies Allie Nelson's Famous Snickerdoodle Cookies Almond Crescent Shortbread Amish Sugar Cookies Andies Candies Cookies Angel Crisps Angenets Applesauce Cookies Apricot Fold-Overs Aunt Edy's Molasses Crinkles Auntie Linda's Ginger Gems Bakeless Dream Cookies Banana Drop Cookies Best Chocolate Chip Cookies in the World Biscotti Biscotti Blueberry Cookies Boiled Chocolate Oatmeal Drop Cookies Bronwnies Brown Sugar Shortbread Brownie Cookies Brownie Delight Brownies Buccaneer Snowballs Buried Cherry Cookies Butter Cookies Butter Nut Balls Butterballs Butterscotch Haystacks C.O.P. Cookies Candy Cane Cookies Candy Cookies Caramel Shortbread Cheesecake Brownies Cherry Buns Cherry Crowns Cherry Winks Chewies Chewy Noels Chinese Chews/Haystacks Chocolate Chip Cookie Bars Chocolate Chip Cookies Chocolate Chip Meltaways Chocolate Chip Peanut Butter Cookies Chocolate Christmas Trees Chocolate Cream Cheese Squares Chocolate Crinkles Chocolate Mint Snow-Top Cookies Chocolate Oatmeal Cookies (no bake) Chocolate Snowball Cookies Chocolate Streusel Bars Chocolate Sundae Cookies Chocolate Walnut Crumb Bars Choco-Scotch Crunchies Choose A Cookie Dough Recipe Christmas Crackers Christmas Crunch Bars Christmas Ginger Snaps Christmas Macaroons Christmas Mice Cookies Christmas Shaped Cookies Church Window Cookies Coconut Cookies Congo Squares Cookie in a Jar Corn Flakes Cookies Cornflake Christmas Wreaths Cowboy Cookies (oatmeal) Cream Cheese Cookies with Apricot Filling Crème De Menthe Chocolate Squares Crème Wafers Crescent Cookies Crispy Crunchies Date Nut Balls Date-nut Pinwheel Cookies Diabetic Peanut Butter Cookies Disgustingly Rich Brownies Doodles Double chocolate chip cookies Double-Chocolate Crinkles Eatmore Cookies Eggnog Cookies Elizabeth's Sugar Cookies Elves Quick Fudge Brownies Emily Dickinson's Gingerbread Cookie Recipe Emily's Best Brownies Famous Oatmeal Cookies Firemen Cookies Fluffy Shortbread Cookies Forgotten Cookies Frosted Peanut Butter Brownies Fruit Cake Cookies Fruitcake Squares Fry Pan Cookies Gems Ginger Cookies Ginger Crinkles Gingerbread Baby Gingerbread Cookies with Butter Cream Icing Gingerbread Men Gingerbread Men Ginny's Gluten Free Chocolate Chip Cookies Glory's Golden Graham Squares Glory's Sugar Cookies Gramma Chapman's chocolate coconut drops Grandma Elsie's Zimt (cinnamon) Cookies Grandma J's Butter Cookies Grandma Olson's Parkay Cookies Great Grandmothers Sugar Cookies Gum Drop Cookies Gumdrop Gems Haystack Cookies Ho-Ho Bars Holiday Cereal Snaps Holiday Chocolate Butter Cookies Holiday Raisin Walnut Bars Holly Cookies Hungarian Cookies (Little Nut Rolls) Ice Box Cookies Irresistible Peanut Butter Cookies Italian Cookies Jacob's Peppermint Snowballs Jam Bars Jessica's Famous Brownies Jessie's Chocolate Chip Cookies Jubilee Jumbles Juliet's Peanut Butter Blossoms Jumbo Chocolate Chip Cookies Kentucky Colonels Kiefle (cream cheese cookies with jam filling) Kifflings Kiss Cookies Lacy Swedish Almond Wafers Lemon Angel Bar Cookies Lemon Bars Lemon Cake Cookies Lemon Cream Cheese Cookies Lemon Squares Linzer Tarts Log Cabin Cookies Luscious Lemon Squares M&M Cookies Magic Cookie Bars Melt in Your Mouth Cutout Sugar Cookies Melting Shortbread Meme's Cream Cheese Cookies Milk Chocolate Florentine Cookies Mincemeat Cookies Mincemeat Goodies Molasses Cookies Molasses Forest Cookies Molasses Sugar Cookies Mom Mom's Crescent Cookies Mom-Mom's Ginger Cookies Mom's Nutmeg Sugar Cookies Mom's Old Fashion 'Puffy' Sugar Cookies Monster Cookies Moravian Christmas Cookies Nana's Famous Soft Southern Cookies Nitey Nite Cookies No Bake Chocolate Cookies No Bake Chocolate Oatmeal Cookies No Bake Cookies No Bake Cookies No Bake Peanut Butter Cookies No-Bake Chocolate Oatmeal Cookies No-Bake Cookies Norwegian Sugar Cookies Nut Balls Oatmeal Bars Oatmeal Chocolate Chip Nut Cookies Oatmeal Coconut Crisps Oatmeal Cookies Oatmeal Scotchies Old Fashioned Sugar Cookies Ooey Gooey Caramel Chocolate Dunk Ooey Gooey Squares Orange Slice Cookies Parking Lot Cookies Peanut Blossoms Peanut Butter Bars Peanut Butter Blossoms Peanut Butter Cereal Cookies Peanut Butter Chewies Peanut Butter Chocolate Bars Peanut Butter Cookies Peanut Butter Cookies Peanut butter fingers Peanut Butter Reindeer Peanut Butter Surprises Peanut Marshmallow Cookies Pecan Puff Cookies Peppermint Snowballs Peppernuts Persimmon Cookies Persimmon Cookies Petey's Yummy Spicy Almond Thins Pfeffernuesse Pffefferneuse Cookies Pineapple Filled Cookies Pizzelles Potato Chip Cookies Potato Flake Cookies Praline Cookies Praline Strips Pterodactyl Nests Pumpkin Bars Pumpkin Bars Pumpkin Chip Cookies Pumpkin Chocolate Chip Cookies Pumpkin Cookies Queen Biscuits Quick Cookies Raised Sugar Cookies Raisin Filled Oatmeal Bars Raspberry Meringue Bars Really Peanutty Butter Cookies Reese`s Brownies Reese's Peanut Butter Bars Rich Flavor Christmas Cookies Rich Lemon Bars Ricotta Cheese Cookies Royal Almond Christmas Bars Rudolph Cinnamon Cookies Russian Tea Cookies Russian Teacakes Samantha & Kelsey's Chocolate Chip Cookies Sand Art Brownies Santa Claus Cookie Pops Santa Claus Cookies Santa's Butterscotch Melts Santa's Shorts Santa's Special Squares Scotch Cakes Scotch Shortbread Scotcharoos Scotcheroos Seven Layer Cookies Short Bread Cookies Shortbread Skor Squares Snicker Doodle Cookies Snickerdoodles Snickerdoodles Snow Balls Sour Cream Apple Squares Sour Cream Christmas Cookies Special K Cookies Spice Cookies Spicy Oatmeal Raisin Cookie Spritz Cookies Stained Glass Window Cookies Stir & Drop Sugar Cookies Sugar Cookies Sugar Cookies Sugar Cookies Swedish Pepparkakor (Pepper Cake) Cookies Swedish Sugar Cookies Sweet Marie's Swiss Treats Taralle (Italian Cookies) Tea Time Tassies Texas Brownies The Best Shortbread in The World Thumbprint Cookies Thumbprint Cookies Toffee Squares Traditional Christmas Sugar Cookies Traditional Gingerbread Men Cookies Triple-Chocolate Chip Cookies Ultimate Chocolate Chip Cookies Vanilla Waffer Balls Walnut Butter Cookies Walnut Crumb Bars White Chip Chocolate Cookies Wild Oatmeal Cookies Will's Famous Apple Jack Cookies Yummy Yummy Peanut Butter Blossoms

Subscribe to:

Comments (Atom)