Lots of data lately about the taker/producer ratios in the U.S. Nationally, there are 1.2 people working and paying taxes (or not) in the private sector for every welfare recipient and/or government employee. But some states, there are more FSA/government employees than actual workers in the private sector. Not surprisingly, these are considered “death spiral” states, because they are functionally, if not literally, insolvent. When takers extract more money than people pay in, the state is bankrupt.

I happen to live in one of these states. Terrifying to say the least. All this talk about “getting out of dodge”. If property taxes, and state taxes in general, are so high, people won’t/can’t buy your house or afford to relocate. No lifeboats for us people damned to living in a death spiral state.

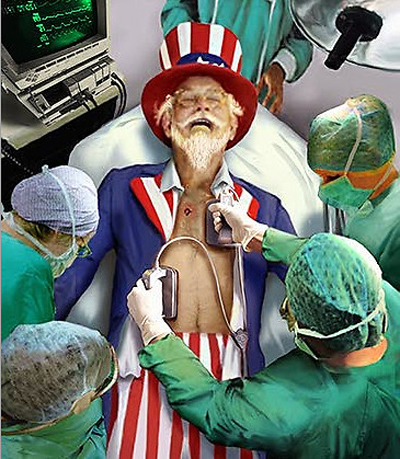

The 11 “Death Spiral” States

Submitted by Tyler Durden on 12/04/2012

Submitted by Tyler Durden on 12/04/2012

Eleven states made Forbes’ list of danger spots for investors including California, New York, Illinois, and Ohio. They warned (and with the cliff it is even more critical), if you have muni bonds in these states – clean up your portfolio; if your career takes you there – rent, don’t buy! Two factors determine their list of ‘fiscal hellholes’. The first is whether there are more takers (someone who draws money from the government) than makers (the gainfully employed). The second is a state credit-worthiness score (via Conning) based on large debts, uncompetitive business climates, weak home prices, and bad trends in employment. Conning rates North Dakota the safest state to lend money to, Connecticut the most hazardous. A state qualifies for the Forbes’ death spiral list if its taker/maker ratio exceeds 1.0 and it resides in the bottom half of Conning’s ranking. See below for the 11 states to avoid…no matter what Bob Toll, Larry Yun, Bob Pisani, or Alexandra Lebenthal tells you..

No comments:

Post a Comment