So the world financial system is a house of cards where each instrument’s false value is artificially supported by another instrument’s false value. The fuse of the world financial market time bomb has been lit. There is no longer a question of IF it will happen but only WHEN and HOW. The world lives in blissful ignorance of this.

Stockmarkets remain strong and investors worldwide have piled into government bonds in a perceived flight to safety. Due to a century of money creation (and in particular since the 1970s) by governments and by the fractal banking system, investors believe that stocks, bonds and property can only go up. Understanding risk and sound investment principles has not been necessary in these casino markets with guaranteed payouts for anyone who plays the game. Maximum leverage and derivatives have in the last 10-15 years driven markets to unfathomable risk levels, with massive rewards for the participants.

In the meantime central banks are cranking up the printing presses but as Bernanke recently said quantitative easing is an “inappropriate” description of what should be called “securities purchases”! Who is he kidding? What the Fed is buying has nothing to do with “securities”. There is no security whatsoever in the rubbish the Fed is purchasing. They are buying worthless pieces of paper with worthless pieces of paper. This is the Ponzi scheme of all Ponzi schemes.

Let us be very clear, this financial Shangri-La is now coming to an end. The financial system is broke, many western sovereign states are bankrupt and governments will continue to apply the only remedy they know which is issuing debt that will never ever be repaid with normal money.

So why does the world still believe that the financial system is sound?

- Firstly, because this is what totally clueless governments are telling everyone and this is what investors want to hear.

- Secondly, whether governments apply austerity like in parts of Europe or money printing as in the US, investors want to believe that any action by government is good, however inept.

- Thirdly, market participants are in a state of false security due to shortsightedness and limited understanding of history.

- Fourthly, as long as they can benefit from inflated and false asset values, the market participants will continue to manipulate markets.

- Fifthly, there has been a very skilful campaign by the US to divert the attention from their bankrupt economy and banks `to small European countries like Greece, Ireland or Portugal. These nations, albeit in real trouble, have problems which are miniscule compared to the combined difficulties of the US Federal Government, states, cities and municipalities.

Hyperinflation Watch

The result of massive money printing is a collapsing currency, leading to escalating prices and eventually hyperinflation. This is in simple terms how every hyperinflationary period in history has happened. If in addition, there are world shortages of food, energy and other commodities, this will accelerate the process.

There are currently a number of indicators all pointing to escalating money printing and an imminent start of a hyperinflationary era. Here are some of them:

- Fiscal Gap widening at alarming rates in many major economies.

- Commodity prices at all-time highs.

- Long term interest rates rising.

- Most Currencies falling.

- Precious Metals at all-time highs against most currencies.

Tax receipts are collapsing and government expenditure soaring in many major economies including virtually all southern European countries as well as in the UK. James Turk has produced on his fgmr.com site two excellent graphs for the USA and the UK showing the extreme severity of these two countries’ deficits.

US & UK ON THEIR WAY TO BANKRUPTCY

The USA and the UK are the favourites to reach hyperinflation first amongst major economies. Both these countries will experience major problems in 2011. Also many other nations have unsustainable debt levels which will never be repaid with normal money.

GOVERNMENT DEBT WILL NEVER BE REPAID

Commodity Prices

Commodity prices have increased 26% in the last 12 months and 77% in the last 24 months based on the Continuous Commodity Index (CCI). So whilst most economies publish inflation rates of 1-3%, the real cost of food and energy is surging. The US government, which doesn’t eat or use energy, recently published the adjusted 12 months’ Consumer Price Index (ex food and energy) of 0.8% per annum. Whilst most people are struggling with a massive increase in their cost of living, the US government is continuously adjusting and manipulating the published figures. There are lies damn lies and US government statistics. Who are they fooling!

Long Term Interest Rates

In spite of US government debt being totally worthless, investors have bought more than ever, with virtually no return, in a world drowning in sovereign debt paper. We have for some time stated that the US bond market is one of the biggest financial bubbles ever. As we forecast back then, the market turned down (rates up) in January 2009. A 14 month correction ended in August 2010. Since then both the 10 year and 30 year US Treasury bonds have moved up one full per cent. So investors are finally waking up to the enormous risks in the financial system by selling government debt. We expect both short and long interest to surge in 2011 in many countries and to reach well into double digits in the next few years.

Long Term Interest Rates

In spite of US government debt being totally worthless, investors have bought more than ever, with virtually no return, in a world drowning in sovereign debt paper. We have for some time stated that the US bond market is one of the biggest financial bubbles ever. As we forecast back then, the market turned down (rates up) in January 2009. A 14 month correction ended in August 2010. Since then both the 10 year and 30 year US Treasury bonds have moved up one full per cent. So investors are finally waking up to the enormous risks in the financial system by selling government debt. We expect both short and long interest to surge in 2011 in many countries and to reach well into double digits in the next few years.

INTEREST RATES WILL RISE STRONGLY

In spite of interest rates at minimal levels, both sovereign states and individuals have major problems servicing current debt. With interest rates likely to rise to at least 12-15% and probably higher, no one will be able to service debt with “normal money”. Add to that the fact that government debt will surge in most countries. The US debt is currently $ 14 trillion. It is likely to rise to at least $20 trillion in the next few years and probably a lot higher. The interest cost for the US government at that stage is likely to be at least double the tax revenue. One would assume that the US government is well aware of what their ruinous actions are leading to. But in spite of this, they continue to increase the deficit by reducing fiscal revenues and increasing spending. What planet are they living on! What is absolutely self-evident is that they will not clear up their own mess, as the present government will be a one term wonder!

Currencies Declining

Since 1971, the value of the US dollar (paper money) has gone down 97.5% against real money (gold). Since Nixon abolished gold backing of the US dollar in 1971, both the dollar and most other currencies have been totally destroyed by reckless government. Nixon should not have been impeached for Watergate. Instead he should have been prosecuted and jailed for destroying the world’s currency system. Concurrently, banking developed into a fractal system whereby banks could lend massive multiples of their deposits and capital. All of this has served to drive up asset prices to totally unsustainable levels.

All currencies are declining against gold but some faster than others. The US dollar for example is down 78% against the Swiss Francs since 1972. During the same period the pound has declined a massive 85% against the Swiss Franc. Both the dollar and the pound are now at all-time lows against the Swiss currency. But the Swissy is only strong relative to weak paper currencies because against real money/gold the Swiss Franc has declined 87% since 1972.

Currencies Declining

Since 1971, the value of the US dollar (paper money) has gone down 97.5% against real money (gold). Since Nixon abolished gold backing of the US dollar in 1971, both the dollar and most other currencies have been totally destroyed by reckless government. Nixon should not have been impeached for Watergate. Instead he should have been prosecuted and jailed for destroying the world’s currency system. Concurrently, banking developed into a fractal system whereby banks could lend massive multiples of their deposits and capital. All of this has served to drive up asset prices to totally unsustainable levels.

All currencies are declining against gold but some faster than others. The US dollar for example is down 78% against the Swiss Francs since 1972. During the same period the pound has declined a massive 85% against the Swiss Franc. Both the dollar and the pound are now at all-time lows against the Swiss currency. But the Swissy is only strong relative to weak paper currencies because against real money/gold the Swiss Franc has declined 87% since 1972.

DOLLAR DECLINE WILL ACCELERATE IN 2011

As a consequence of accelerated money printing, all paper currencies will fall precipitously against gold in the next few years. Therefore all paper money should be avoided and especially the Dollar, the Pound and the Euro.

Precious Metals to reach unthinkable heights

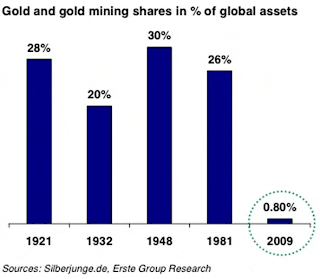

Gold has gone up 40 times against the Dollar in the last 40 years and almost 6 times in the last 11 years. Very few investors have participated in this rise since the 1999 low at $ 250. Less than 1% of world financial assets are invested in gold and gold stocks. Between 1920 and 1980 circa 25% of financial assets were invested in gold and gold stocks.

Precious Metals to reach unthinkable heights

Gold has gone up 40 times against the Dollar in the last 40 years and almost 6 times in the last 11 years. Very few investors have participated in this rise since the 1999 low at $ 250. Less than 1% of world financial assets are invested in gold and gold stocks. Between 1920 and 1980 circa 25% of financial assets were invested in gold and gold stocks.

THERE WILL NOT BE ENOUGH GOLD

The major rise in gold in the last 11 years has been a stealth move with very few investors participating. The dilemma is that there is not enough gold to satisfy the coming increase in demand. We have in previous articles forecasted the gold price to reach anywhere between $ 6,000 and $ 10,000 in the next few years – see “Gold entering a virtuous circle”. As we explained at the time, these are totally realistic targets without the effect of hyperinflation.

GOLD WILL SURGE IN 2011

Bearing in mind that we are likely to see hyperinflation in the US, the UK and many European countries, the $6-10,000 target for gold is much too low. The dilemma is that it is absolutely impossible to predict how much money will be printed by governments. In the Weimar republic gold reached DM 100 trillion. But it is really irrelevant what level gold and other precious metals will reach in hyperinflationary money.

What is much more important to understand is that physical gold (and silver) will protect investors against losing virtually 100% of the purchasing power of their money. Whatever real capital appreciation gold will have in the next few years is of less importance. But what is vital, is that physical gold (stored outside the banking system) is the ultimate form of wealth protection both against a deflationary collapse and a hyperinflationary destruction of paper money.

Throughout history gold has protected investors against various calamities but this time, holding physical gold will be absolutely critical to financial survival.

Source GoldSwitzerland.com

What is much more important to understand is that physical gold (and silver) will protect investors against losing virtually 100% of the purchasing power of their money. Whatever real capital appreciation gold will have in the next few years is of less importance. But what is vital, is that physical gold (stored outside the banking system) is the ultimate form of wealth protection both against a deflationary collapse and a hyperinflationary destruction of paper money.

Throughout history gold has protected investors against various calamities but this time, holding physical gold will be absolutely critical to financial survival.

Source GoldSwitzerland.com

10 comments:

so what are they telling us we don't already know? we are all f'd!

Gold has been pushed and pushed for the last couple years, Look for a big sell off by the greedy powers that be.

1053-I agree, eventually there should be a massive selloff(ala early 80's post Carter). When, or if it'll happen is the question. There has been a worldwide policy enactment of purposefully devaluing currencies by those in power. Hard to say if they'll ever shut down the printing presses.

Personally, I'm more invested in diversified miners; as a broad commodity play.

If gold is so valuable, why are they willing to take CASH for it?? Think about it.

12:23 that probably the most sensible thing i've heard anyone say in a long time.

They sell gold, this is nothing but a sales gimick to scare you into buying gold and making them rich.

Gold and Silver are real money and always have been. There is 15 times more silver in the earth than gold. Therefore silver should be worth 1/15th the value of gold - but it is not. Look for silver to move more dramatically than gold.

People will sell gold for cash. However, the point is this: right now it takes more cash than ever before. Ie. gold's value in US Dollars has risen sharply and will continue to do so. Why? Because there are too many dollars. Gold is not "more valuable" than before. Gold simply has a value as real money. It is rare and beautiful. It is MONEY (US Dollars) that have "lost its value vs. gold" - get it?

It now takes $1,400 US Dollars to buy an ounce of gold whereas a few months ago it only took $1,000 US Dollars. The gold is NOT more valuable than before. Instead, the US Dollar is LESS valuable.

Gold and Silver are a STORE OF VALUE because they are real money as opposed to fiat money. As fiat money loses its value, the gold and silver will have relatively more value than before.

These facts and corresponding graphs & analysis must be TOP SECRET. Our "leaders" are apparently not aware of what every economist that can read and write already knows. Spending cannot and will not rescue us. In fact, our debt is already at levels that we cannot repay (under ANY scenario, except by total confiscation of all property and valuables AND total default on foreign debt). I'll tell you something else....gold and silver won't stop a single hooligan who wants to take your food and water. GUNS and AMMO will be worth a whole lot more than any "precious metal"....lol...stock up NOW. This circus ride will be coming to a stop and it will be fast. And with little warning. Some ammunition is sold out the day it arrives in this area. Wonder why?

Anonymous 3:36 and lmclain are the only ones that have it right so far. Gold and silver were the primary forms of currency for food or anything else necessary after WWII, when Germany fell. And that only affected Germany, this time it's America and the rest of the world. I'm into art, and high ticket art is doing better then ever. Why? because Big money knows that commodities like precious metals and art always have long term value and stability. The U.S. Dollar is virtually worthless outside of our country. When banks crash big money looses everything they've got in there, unless they've been smart enough to put their money into tangable real assets. The most recent downward monetary spiral is due to the Democratic Give-Away programs now in place. Pure waste! Accomplishs nothing but much deeper debt.

And lmclain is especially right because when the crash comes, and be certain, it's coming, it will probably happen overnight and be announced in the news and TV, that a state of emergency is now in place, that's what they'll tell you, so you should come into shelter from the monsters and the sky that's falling and your government being in control will help and protect you from that bad stuff around you. That safety will be their Big Homeland Security Lie to YOU, in hopes of convincing you come to shelter and lay down your arms (make yourself defenseless and dependant on them), and to take further control of your country and those that believe the LIE. Just as lmclain said, stockpile guns and ammo, expect what you think "Could Happen" to actually happen, because it's going to. That ****ing George Storos the billionaire that manipulated the Democrat electorial votes away from Hillary because Obama was and is his American Presidentual puppet. He pulls the strings daily, never showing his rotten face, waiting for the crash to come, so he can pick up all the greedy pieces in our country and the rest of the world he he goes. He's the snake in the grass you never see and in the near past has manipulated and taken down plenty of monetary systems in the world for his own personal greed. Read his bragging on wiki which he has control over every word of (nothing is in there that he doesn't approve). You don't have to wonder what I hope happens to that rotten snake. Get some of that worthless paper out of your bank and stash it, your gonna need everything you have on hand just to survive. Store as much food as you can afford to. Don't bury that head any longer, it's not gonna help or save you! This isn't a doomsday comment, all you have to do is look at the present state of the world, it's simple common sense. All hunters in this country are armed and their entire lives have been lives of freedom and most are intellegent and have used good common sense as their main guide in life. No government, foreign or domestic will ever walk over them as easily as your government did with the American citizens at Ruby Ridge or Camp Davidian because they intentionally burnt to death men, women and children to make a point to those that in this country that are willing to stand up against a tyranical, dictitorial government and show they how they meant business. Everyone that participated in that event are intentional and premeditated MURDERERS, every single one. Be certain we're NOT going to lay down and WE'RE heavily ARMED. And your military? Know for certain that they are our fathers, our mothers, our brothers and sisters and our children, They STAND with US, because we are them and we Love our country.

3:59

We must all hope and pray that you are right.

I fear this government and its technology

Post a Comment